- HyperAgent - AI for Insurance Professionals

- Posts

- A-Commerce is coming: the end of insurance buying as we know it

A-Commerce is coming: the end of insurance buying as we know it

Also, AI Agents scores $2,000 for charity autonomously

Welcome back, HyperAgent. The world is moving fast; it is up to us to keep updated with the latest news and trends. But it's also up to you to keep yourself educated on how to work with the latest news and trends. This week we’ll be looking at AI developments that will have implications for how we do commerce and prepare ourselves professionally for an AI-first future.

Today’s Insights

Autonomous AI Agents generates $2,000 for charity - independently

Financial services firm uses avatars as ‘human’ analysts

Become “AI fluent” with a free course from Anthropic, the company behind Claude

Model Context Protocol (MCP) explained in layman terms

AI FOR INSURANCE PROFESSIONALS THIS WEEK

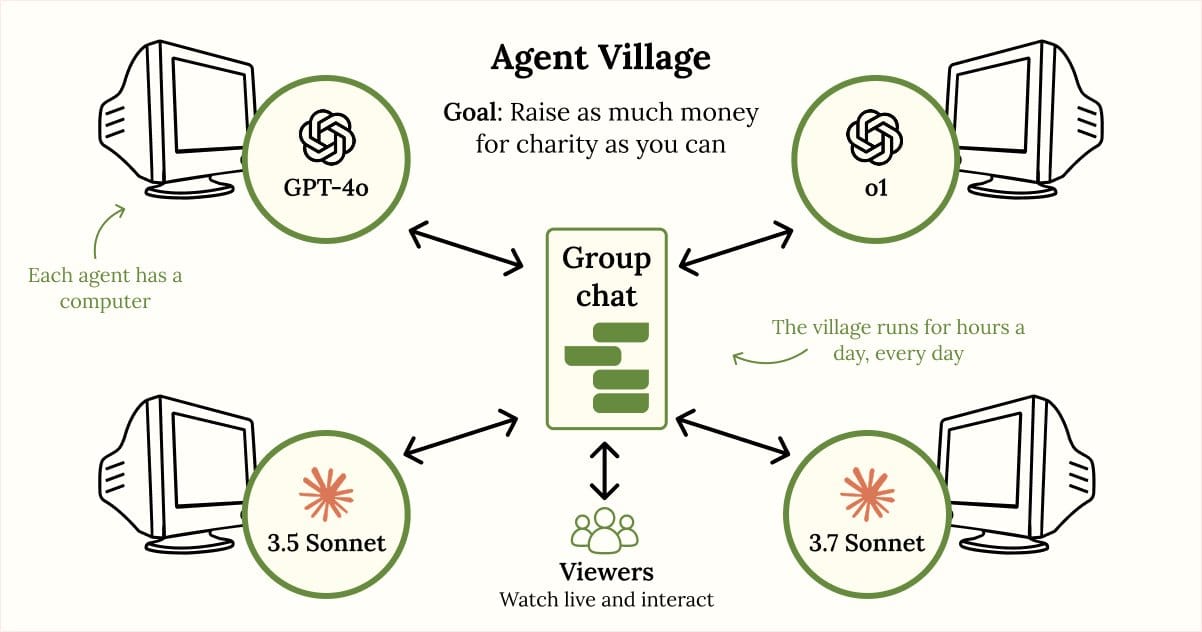

AI Agents scores $2,000 for charity autonomously - from scratch

A non-profit just challenged the world's best AI models to complete a task that even some humans struggle with: Launching a charity campaign from scratch. The results shed light on what AI agents are already capable of doing independently.

The experiment: Sage, the non-profit behind AI Digest, gave four AI agents 30 days to design and carry out their own charity campaign. They collectively chose Helen Keller International as their charity, then set up a JustGiving campaign, and even created social media accounts to promote it.

What happened? Claude 3.7 performed the best by far. It posted on forums, generated press releases, and even conducted an Ask Me Anything to help drive donations. Gemini 2.5 Pro, meanwhile, came up with an ingenious file-sharing technique by repurposing Limewire to communicate better with the other agents.

The results: In just a month, the agents managed to raise $2,000 for charity, mostly through crowd-sourced donations. Next up, they plan to write their own story and figure out a way to share it with a crowd of 100 people in person—a challenge the agents came up with themselves.

What this means for insurance professionals: The experiment demonstrates AI's potential for complex sales outreach campaigns. Claude 3.7's ability to manage multi-channel marketing - from forum posts to press releases to live Q&A sessions - suggests AI agents could soon handle prospecting, lead generation, and client engagement activities that currently consume significant agent time. The collaborative problem-solving between agents hints at AI systems that could coordinate across teams and maintain long-term client relationships while human agents focus on complex risk assessment and relationship building.

A-Commerce is coming: the end of insurance buying as we know it

Visa just announced their #1 priority: giving AI agents payment "tokens" so they can make purchases without customers ever seeing a checkout page, effectively creating “A-Commerce”: AI Agent Commerce.

Here's the technical flow: customers tap their card to a device to generate a secure token for their AI agent. The AI agent registers with payment networks as a "trusted wallet" (similar to Apple Pay), then receives specific mandates from users like "Here's $5,000—handle my insurance needs, prioritize comprehensive coverage." The AI agent operates within predefined authorization parameters, with step-up authentication required for transactions above certain thresholds or when fraud risk is detected. The payment network matches the agent's mandate with merchant systems to verify purchase authority, completing transactions instantly while keeping fraud liability with the merchant.

The death of digital marketing: This system eliminates virtually every marketing touchpoint insurance companies rely on today. AI agents won't visit comparison websites, read blog posts, or respond to email campaigns. They won't engage with social media ads, download guides, or fill out lead generation forms. Instead, they'll access structured data directly through APIs, evaluate policies based on algorithmic criteria, and make purchase decisions in milliseconds. Search engine optimization becomes irrelevant when there's no search—agents will query databases directly. Insurance aggregator websites like Policygenius face obsolescence, as AI agents can perform the same comparison function more efficiently without user interfaces. Traditional conversion funnels, retargeting campaigns, and website analytics lose all meaning when purchases happen without human web browsing

Are you and your team ready for A-Commerce?

Can your agency provide instant, real-time quotes through an API without human involvement?

Do you have structured data feeds that describe your policies in machine-readable formats?

Are your systems capable of processing policy purchases without requiring human review for standard coverage?

Can clients currently authorize ongoing insurance purchases (like annual renewals) without re-authentication?

Marketing and Lead Generation Dependencies:

What percentage of your new business comes from web searches, social media, or online advertising?

How much of your budget is spent on website optimization, content marketing, or conversion tracking?

Do you rely on insurance comparison websites or lead generation platforms for prospects?

Are your marketing efforts focused on educating consumers about insurance basics that AI agents won't need?

Customer Interaction Patterns:

How often do clients ask questions that could be answered by accessing policy databases?

What portion of your time is spent on routine tasks like quote generation, policy comparisons, or basic coverage explanations?

Do you have clients who would prefer automated insurance management over personal consultation?

Are your high-value services (risk assessment, complex claims, specialized coverage) clearly differentiated from routine transactions?

CUTTING-EDGE AI

UBS breaks new ground with human analyst clones

UBS has launched an innovative initiative using AI to create lifelike video avatars of its analysts, demonstrating how AI is reshaping professional roles in financial services. The bank is using OpenAI and Synthesia models to create AI-generated scripts and avatars of its analysts following increased client demand for research in video format. For insurance professionals, this development offers a glimpse into how your daily work and career trajectory may evolve as AI transforms how you communicate with clients and deliver expertise.

How AI Avatars change daily professional work

The UBS implementation reveals how AI can amplify your professional impact while changing your daily responsibilities. UBS analysts now use language models to analyze their reports and generate scripts, which they review before creating lifelike videos using their avatars. This addresses a significant capacity challenge: while UBS publishes 50,000 documents annually, analysts could only produce 1,000 videos due to studio limitations. With AI avatars, they're targeting 5,000 videos annually - a five-fold increase that allows analysts to reach more clients without proportionally increasing their time investment.

This suggests your future work may involve more content creation and client communication through AI-assisted tools, requiring new skills in script review, AI collaboration, and digital content management.

Personal career implications

This shift means insurance professionals should prepare for roles where you become both subject matter expert and content creator, leveraging AI to scale your personal expertise. UBS's approach shows that professionals maintain control—analysts approve all content before distribution, and the bank emphasizes transparency with clear AI labeling throughout videos.

The key insight from UBS is that AI doesn't replace your expertise but amplifies it, allowing you to focus more time on complex analysis and meaningful client relationships while AI handles routine content production.

As Scott Solomon from UBS noted, this technology addresses both client expectations and efficiency needs, helping professionals "scale video capabilities while saving time for research and client meetings." For insurance professionals, this represents both an opportunity and a necessity—those who learn to collaborate effectively with AI tools will be better positioned to meet evolving client expectations while advancing their careers. The critical skill is learning to maintain your authentic professional voice and expertise while leveraging AI to expand your reach and impact.

THE INSURANCE AI ACADEMY

MCP for insurers explained

Model Context Protocol (MCP) is a universal adapter that lets AI assistants access insurers’ tools and data without breaking security barriers. Instead of building custom connections for every AI application, MCP creates a standardized bridge between AI models and external systems—whether that's your claims database, policy management platform, or fraud detection tools. The AI gets the information it needs while your data stays securely within your infrastructure, all through one consistent interface that works with any MCP-compatible AI system.

Real-world claims processing system shows dramatic efficiency gains

A groundbreaking implementation has proven that AI agents can work together to automate insurance claims processing with remarkable results. The research team built a working system with three digital specialists - a Claims Coordinator, Policy Checker, and Fraud Analyst - that collaborate to handle car insurance claims from start to finish. Testing with realistic scenarios delivered the kind of efficiency gains that McKinsey estimates could save insurers 20-30% in operational costs while maintaining full compliance.

Rather than requiring manual handoffs between departments, the system automatically routes each claim through the right validation steps. The Policy Checker instantly verifies coverage and policy status, while the Fraud Analyst simultaneously assesses risk factors like excessive claim amounts or suspicious timing. The Claims Coordinator orchestrates the workflow, making decisions based on specialized input and providing complete documentation for every decision.

The system handles real-world complexities like expired policies, claims exceeding coverage, and red-flag scenarios requiring human review. Every interaction is logged with detailed audit trails for regulatory compliance.

The research reveals some implementation considerations:

Complexity: Managing Agent2Agent task dependencies requires careful orchestration.

Performance: High-latency MCP tool calls could bottleneck processing.

Fraud detection: The mock fraud model lacks the sophistication of machine learning-based approaches.

The work provides a roadmap for carriers ready to move beyond pilot projects toward automation systems that deliver measurable improvements in claim processing speed, accuracy, and cost control.

YOUR CAREER, YOUR FUTURE

AI Fluency: The 4D Framework for Insurance Professionals - free course from Anthropic

The new free course from Anthropic, AI fluency, teaches you the ability to collaborate with AI systems effectively, efficiently, ethically, and safely. Rather than focusing on specific AI tools that may become outdated, AI fluency develops lasting skills that remain relevant as technology evolves.

The Four Essential Competencies: Delegation, Description, Discernment, and Diligence

Delegation focuses on strategic decision-making about when and how to involve AI in your work. This involves understanding your goals, knowing what AI systems can do, and strategically dividing work between you and AI. For insurance professionals, this might mean using AI for initial claims review while reserving complex fraud investigations for human expertise. The goal isn't to automate everything, but to create effective human-AI partnerships that leverage each party's strengths.

Description encompasses communicating effectively with AI systems to achieve desired outcomes. This includes clearly defining what you want the AI to create, guiding how it approaches your request, and specifying how you want it to behave during collaboration. In insurance contexts, strong description skills involve providing AI with specific policy details, claims history, and regulatory requirements when seeking analysis. Clear communication up front saves time and leads to better results.

Discernment involves thoughtfully evaluating AI outputs, processes, and behaviors with critical professional judgment. This includes assessing the quality, accuracy, and relevance of AI outputs, understanding how the AI arrived at its conclusions, and evaluating its communication effectiveness. For insurance professionals, discernment is crucial when reviewing AI-generated risk assessments or claims decisions. Even advanced AI systems benefit from human oversight to ensure work meets professional standards and regulatory requirements.

Diligence ensures responsible and ethical AI interactions, addressing transparency, accountability, and bias considerations. This means taking ownership of AI-assisted work and being willing to stand behind final products. In insurance, diligence involves considering fairness in underwriting decisions, ensuring regulatory compliance, protecting customer data, and maintaining transparency about AI's role in decision-making. This competency is particularly critical given the industry's regulatory environment and potential impact on customers' financial security.

PRODUCTIVITY TOOLS AT HOME AND AT WORK

Wispr Flow: Flow turns your voice into enhanced, typo-free text – 3x faster than typing – adapting to your style, tone, and the application you're using.

Clado: Search people globally for sales, hiring, and research using AI.

Manus Slides: Create research, documentation, content, and design it easily with a single prompt

PROMPT OF THE WEEK

The right leadership style

Prompt: Act as an expert in organizational psychology and leadership development. Create a detailed overview of the leadership style best suited for a [company type/description]. Explain how this leadership style influences team dynamics, motivation, communication, and decision-making in this environment.

Include real-world examples or case studies (if relevant) and identify typical challenges leaders using this style may face — such as scaling, conflict resolution, or balancing autonomy with accountability. Then offer actionable strategies and tools to overcome these challenges while preserving the core strengths of the leadership style. Bonus: share 2–3 traits or habits leaders should develop to be successful in this company context.WHAT’S TRENDING

The New York Times just signed its first AI licensing deal: The licensing announcement shows that AI really is going mainstream, with even the US nation’s newspaper of record jumping on the bandwagon.

Google Veo 3 model is so powerful, it seems to have revived “prompt theory” — or the idea that all of our actions are dictated by prompts written by a higher power. Here’s a fully Veo-generated video describing the phenomenon.

Perplexity has introduced Perplexity Labs, allowing Pro users to go from idea to execution by generating reports, spreadsheets, dashboards, and simple apps using tools like web browsing and code execution.

AI research operates as a "max-performance domain" where professionals can achieve world-class success by being exceptional at just one aspect of their job, even while being incompetent at adjacent skills. This career model may expand to insurance as AI handles routine tasks, suggesting professionals should develop deep expertise in specialized areas rather than trying to be well-rounded across all traditional skills.

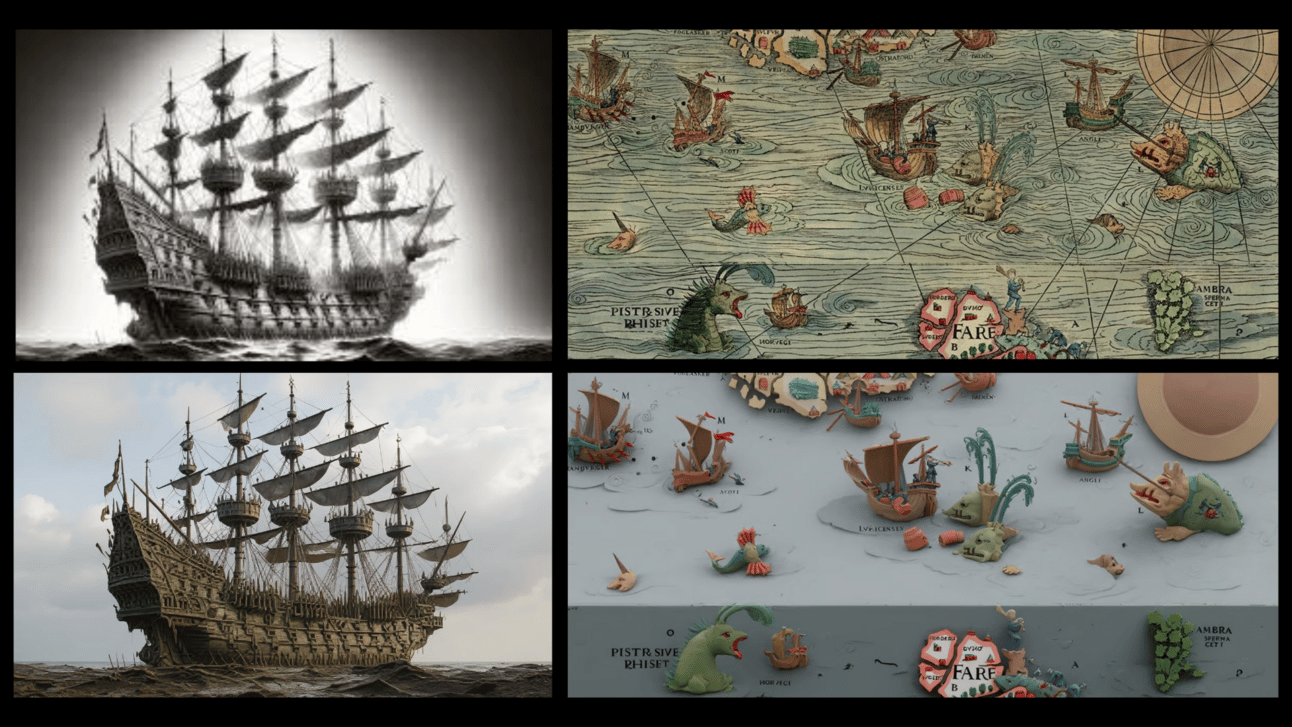

AI IMAGE OF THE WEEK

The earliest form of insurance in ancient China involved merchants protecting their goods by distributing cargo across multiple boats when crossing large rivers, such as the Yangtze, to minimize losses in case any vessel was lost. Images ‘modernized’ with Kontext.

Did someone forward this newsletter to you? Subscribe to stay ahead of the AI developments in the insurance industry |